Disbursement Letter Format

13. Can I include disbursements and taxes when calculating a contingency fee? 14. Can I include a costs award in the amount on which a contingency fee is calculated? 15. Where can I find examples of how to calculate contingency fees? 16. How do the new contingency fee rules apply to class proceedings? 17.

While I've been confused for a local several times during my travels abroad, apparently I act

The Courts in Ontario have developed a practice of calculating reasonable compensation based on 2 ½% of each of the categories of: Revenue disbursements. In addition, a management fee on the gross value of the estate is typically granted. However this practice is not always considered appropriate. The amount of work required to administer an.

Realtor Fees Ontario Let’s Explain

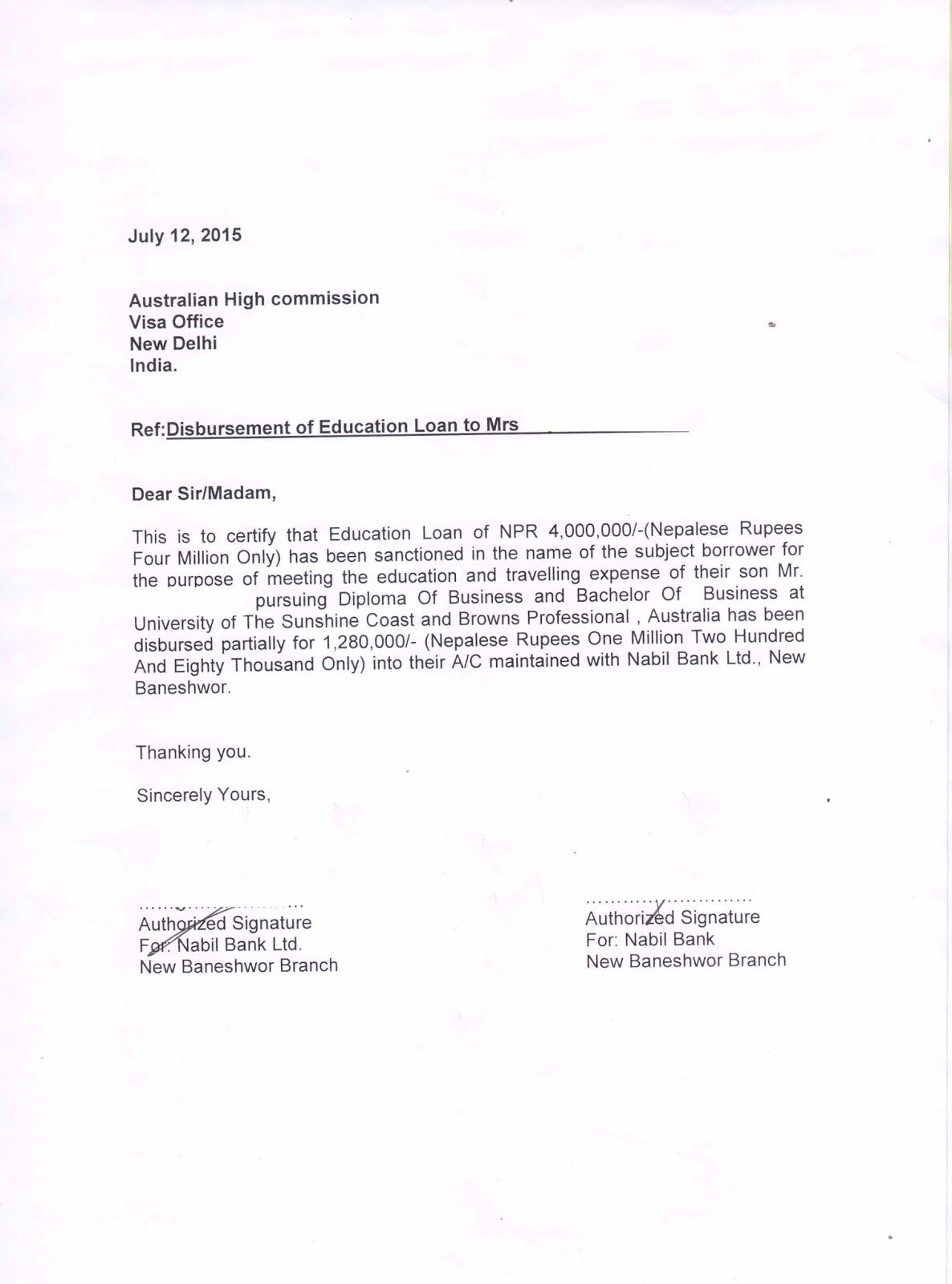

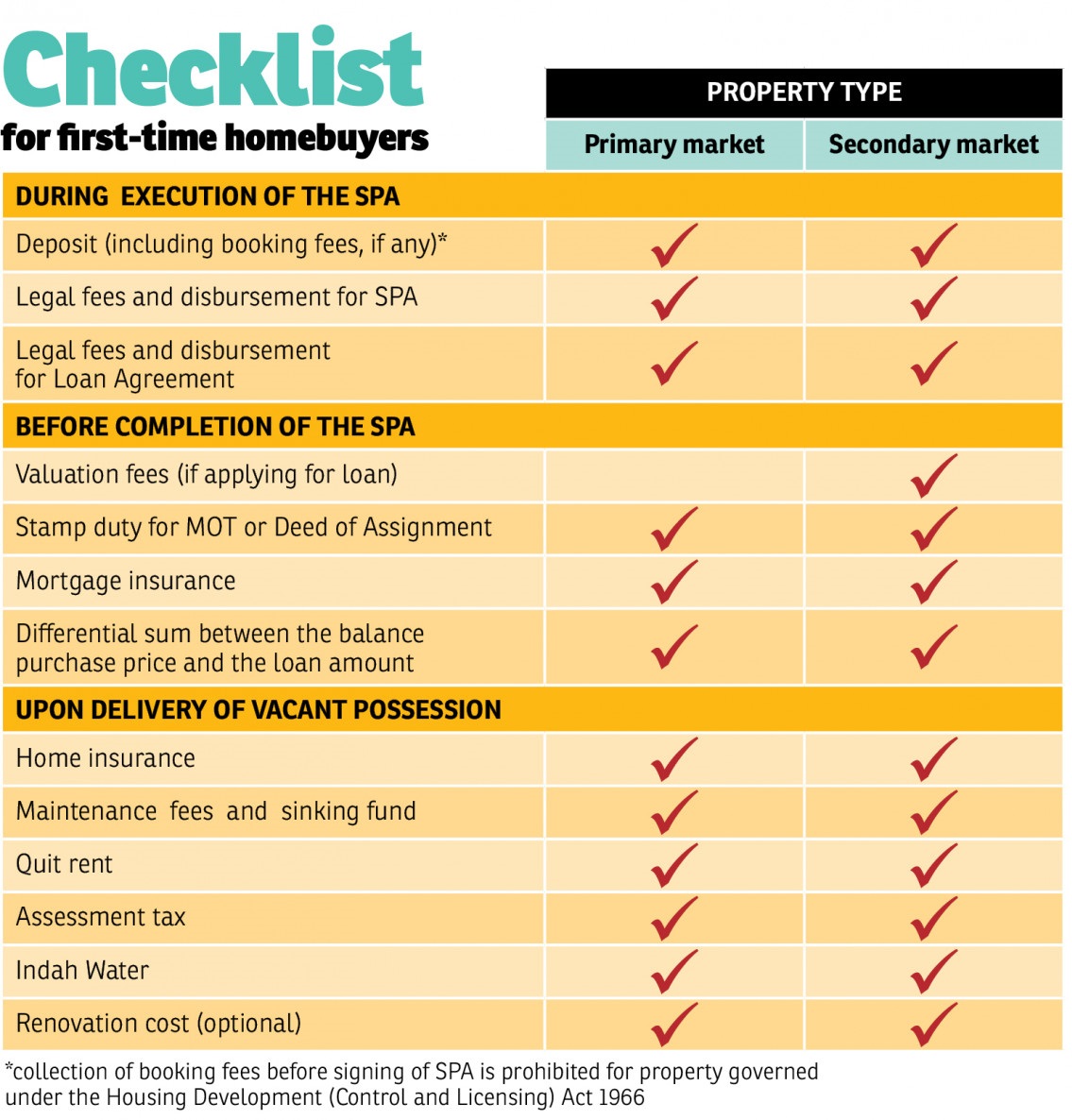

Disbursements are the costs that the lawyer incurs to complete your file, including for searches to ensure that you will get a clean title. Typical disbursements you will find on your lawyer's bill include, but are not limited to: Title Search $350.00. Tax Certificate - $60. Water Certificate - $60. Execution certificate - $12.15/person.

budgetdisbursementrequest

The maximum hourly rate on a partial indemnity scale ranges between $255.00 per hour for lawyers with under ten years of experience to nearly $400.00 per hour for lawyers with over twenty years of experience. Typically these are roughly 60% - 65% of the lawyer's reasonable fees. This is the most common scale that costs are awarded.

letter disbursement template Doc Template pdfFiller

Fair and reasonable fees and disbursements. Lawyers and paralegals are permitted to charge clients for legal fees and disbursements provided the amount charged is fair, reasonable, and has been disclosed to the client in a timely manner. What is fair and reasonable will depend on factors such as. the client's prior consent to the fee.

Destination Ontario Toronto ON

Legal Aid Ontario: Disbursements handbook 7 / 52 8. Block fee certificates Regular disbursements The following three disbursements have been calculated in the block fee payment for all block fee accounts. All other disbursements on a block fee account will be available for selection. • fax charges; • photocopies (except out-of-office.

Occasion marriage celebration cheery hires stock photography and images Alamy

After considering these factors, courts in Ontario will generally award costs on one of the following bases: Partial indemnity: Partial indemnity costs are not specifically defined, but in most cases, costs awarded on this basis result in compensation between 40-60% of the reasonable costs of the winning party.

Real Estate Lawyer Fees Ontario 450 [ Best Reviews ] Online Quote

Disbursements are expenses that a solicitor incurs as part of the process of delivering conveyancing services to a client. The expense is technically the client's, not the solicitor's. A business expense is a payment that falls outside the fees a solicitor charges for completing a conveyancing service. This might include travel costs or the.

much longer the financial, the paid down their repayments and frequently the extra you are able

So, the next time you are contacting law firms on a real estate purchase, make sure to keep these factors in mind to determine if you are getting a comprehensive and accurate quote. This blog post was written by Jason Peyman, a member of the Real Estate and Business Law teams. He can be reached at 613-369-0376 or at jason.peyman@mannlawyers.com.

the best things to do in cornwalll, an awesome city in ontario

Legal fees and disbursements. These fees are charged by a lawyer or notary, and can cost up to $1,200 depending on the complexity of the deal. Your lawyer or notary will arrange all transfers, payments and other factors of the funds for the real estate transaction.. For example, in Ontario, the tax rates on land transfers are: 0.5% on the.

What are the probate fees in Ontario 2022?

The estate will need to pay estate administration tax, which taxes the value of the estate's assets at the time of the will-maker's death. This tax is paid as a deposit when applying to the court for probate. Probate fees are calculated as follows: $0.00 for estate assets valued at up to $50,000. $15.00 per $1,000 for estate assets over.

Disbursement List Views Help Center

Disbursement is the act of paying out or disbursing money. Examples of disbursements include money paid out to run a business, cash expenditures, dividend payments, the amounts that a lawyer might.

chapter 5 Basic Requirements and Certifications for Disbursement YouTube

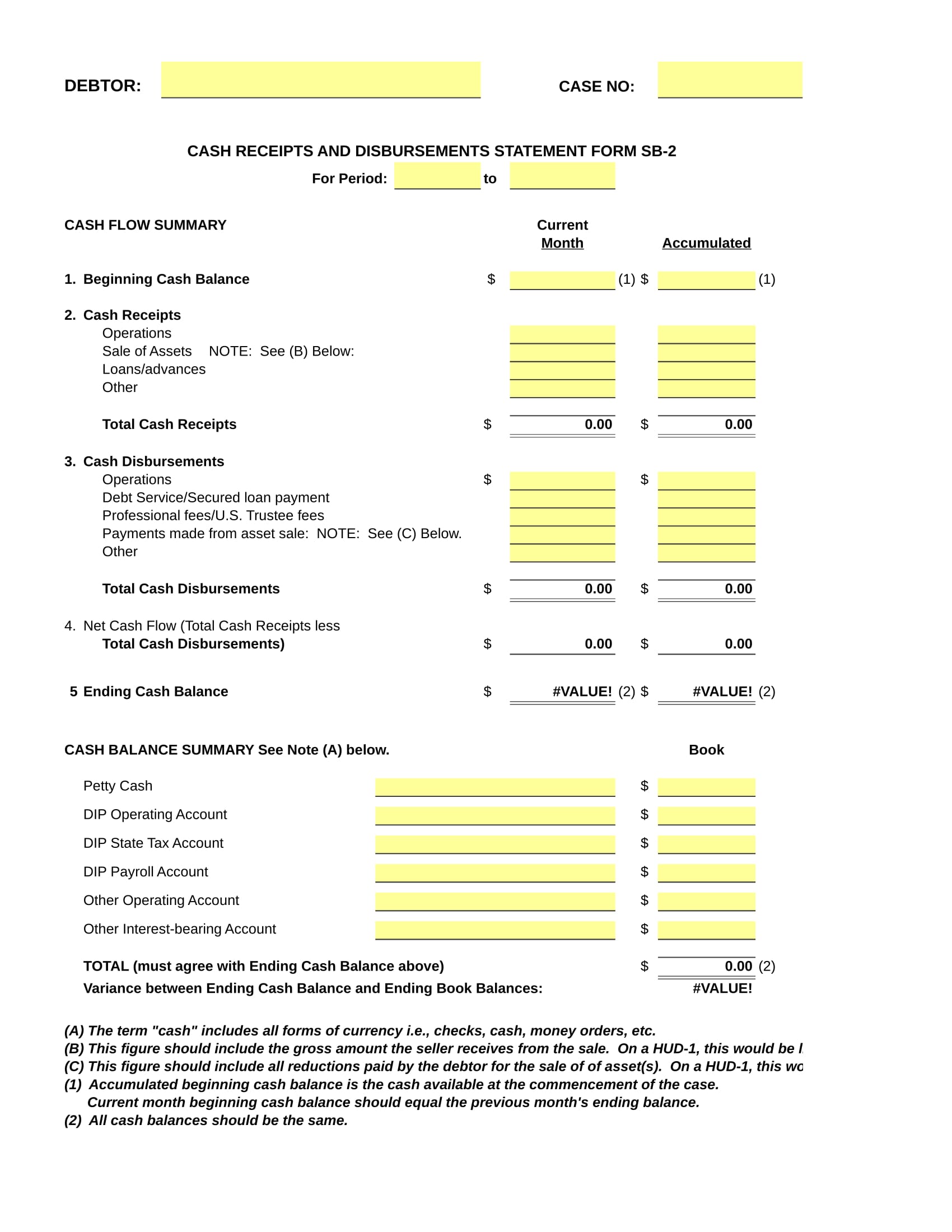

Currently, the prescribed fee scale is as follows: 3% on capital and income receipts; 3% on capital and income disbursements; and three fifths (3/5ths) of 1% of the annual average value of the assets, as a care and management fee (although this last fee has been determined to be an extra fee, and is only included as part of compensation in some.

Decoding Tow & Impound Fees for Stunt Driving in Ontario

HOURLY RATES. Hourly rates are the most common type of fee. Today a $150 hour is probably the lowest rate you will find. They go up from there . . . $500 an hour is common. Know what your lawyer charges before you run up a bill. Most lawyers have a trial rate, by day or by court appearance, and it's often higher than their normal hourly rate.

Ontario Property Recovery

What are disbursement costs and why do they matter? 902.468.9802. info@scotialawinc.ca.

Cost of Buying House in Malaysia

That means there's a fee, also known as the disbursement fee, which is part of our ancillary charges. Shipping Ship Domestic Services - FDS 2.0

.