How Much Tax Do You Pay On Buy To Let Property Property Investing UK YouTube

The benefits are 1) not having to find a buyer and 2) transferring the boat fairly quickly with the charity processing the paperwork and providing an IRS Form 1098-C. If the charity sells the boat, you can only claim a tax deduction equal to the sales price, not your initial appraisal. Taxes are fluid and tax laws change not only by.

Do You Pay Tax On A Property Investment (Ep154)

There are several options as to how a buyer can avoid sales tax. Of course, the simplest method is to purchase a boat in a nontaxing state, such as Delaware or Rhode Island. But let's be honest, understanding boat taxes by state is a lot to ask for when buying a boat. Although it may be helpful knowledge if the buyer also plans to store and.

Do you get taxed for transferring cryptocurrency in Australia? Cointracking

Boat owners who live in states with personal property tax laws may be required to pay an annual tax on their vessels. These taxes, as with sales and use taxes, vary between jurisdictions and are based on the assessed value of your boat. Some states offer exemptions or credits for specific types of boats, so be sure to check the laws in your area.

Do you pay tax on Prize Money? ER Grove & Co

The 3 Main Types of Taxes that Boat Owners Pay First, there's the sales tax, which you likely will have to pay when you buy the boat.This sales-tax rate varies from state to state, and the swings can be big. Delaware and Rhode Island do not require a sales tax at all, and in some states, sales tax is only applied up to a certain amount of the boat's purchase price.

Do You Pay National Insurance on an Apprenticeship? Complete Apprenticeship Guide

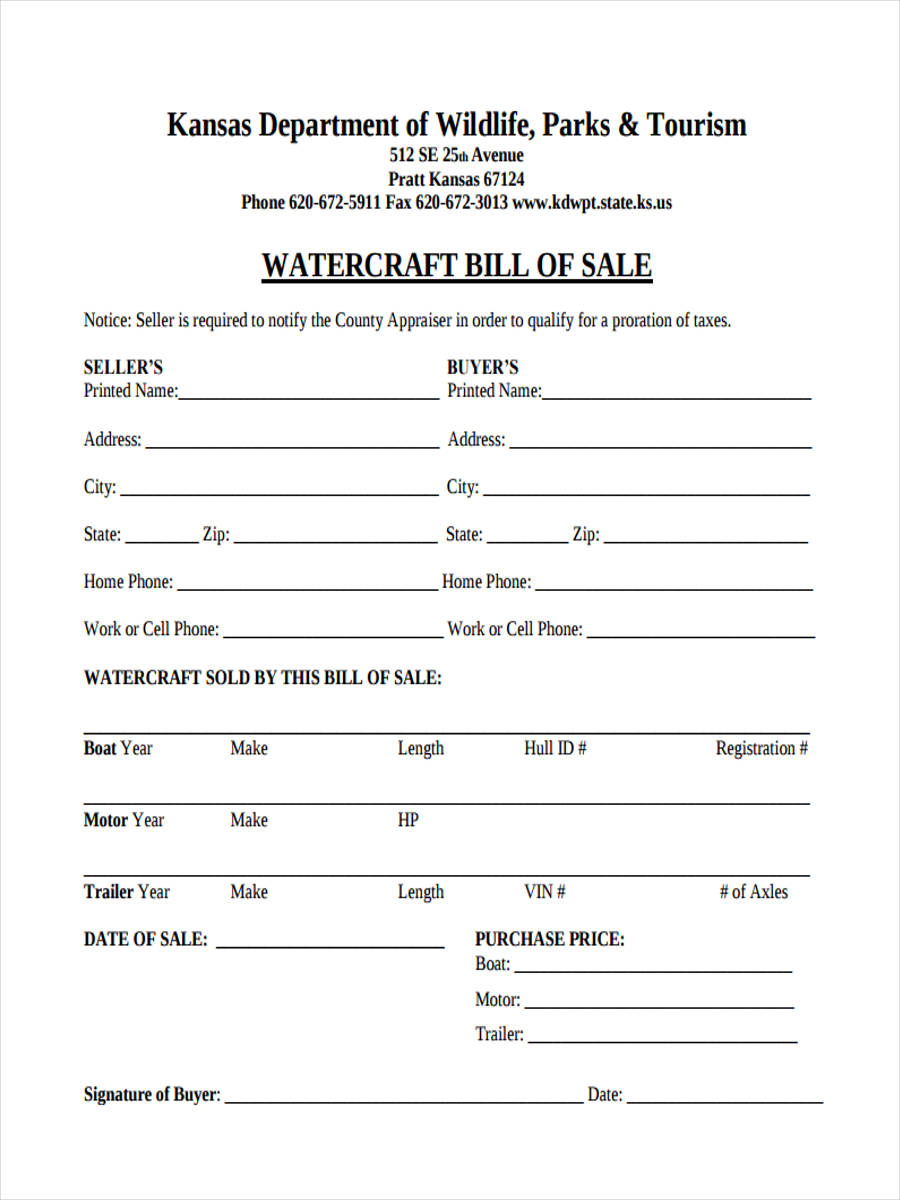

How I Smoothly Bought a Used Boat From a Private Seller. 1. Plan your budget and negotiate the price. 2. Personally inspect the boat and request/do a trial run. 3. Hire a marine surveyor or mechanic to inspect the vessel. 4. Don't forget to request a bill of sale.

Do I pay tax on Bitcoin gains? Arthur Hamilton

Brief recap. As though you don't already know, Maine charges 5.5% sales tax on all purchases except those exempted by statute. The list of sales exempt from sales tax is found in Title 36 Section 1760, and that statute lists no less than 101 sales on which no tax is payable. It includes groceries, as we all know, but also bibles, fuel used to.

Do you pay tax when you sell your house UK? YouTube

So you, as the buyer, will only pay sales tax on the boat itself to the DMV. So, for example, if your bill of sale reflects $250,000, but $75,000 is separately itemize for the two 250 horsepower outboard engines on the boat - then the DMV is not going to charge you sales tax on the outboard engines.

Sales Tax by State Here’s How Much You’re Really Paying Sales tax, Tax, Filing taxes

Current Tax Law & How You Can Benefit. Currently, Florida has a sales and use tax for boats which is set at 6% of the purchase price. However, Florida caps the total tax amount due on a vessel at $18,000. This tax cap law went into effect July 1, 2010, and is still in effect today. If you're in the market for a boat valued at $300,000 or more.

DO YOU PAY TAXES ON DIVIDENDS? An Explanation of How Dividends are Taxed YouTube

Sales Tax and VAT: In many countries such as the UK, there is no sales tax or VAT on the sale of used boats between two private individuals. If, however, you use a broker to sell your boat, there will be VAT on their services. In the United States there are various taxes imposed on owners when buying a boat (see our Guide to Paperwork and Taxes.

Why do you pay tax? (Part 1) YouTube

This isn't as difficult as you're thinking. Almost any motor vehicles registration office (where you go to get your drvs license and tabs) can do the whole process. As I stated before, in MN on a USED boat sale, you have to pay tax on the value of the part that is used on the road-the trailer.

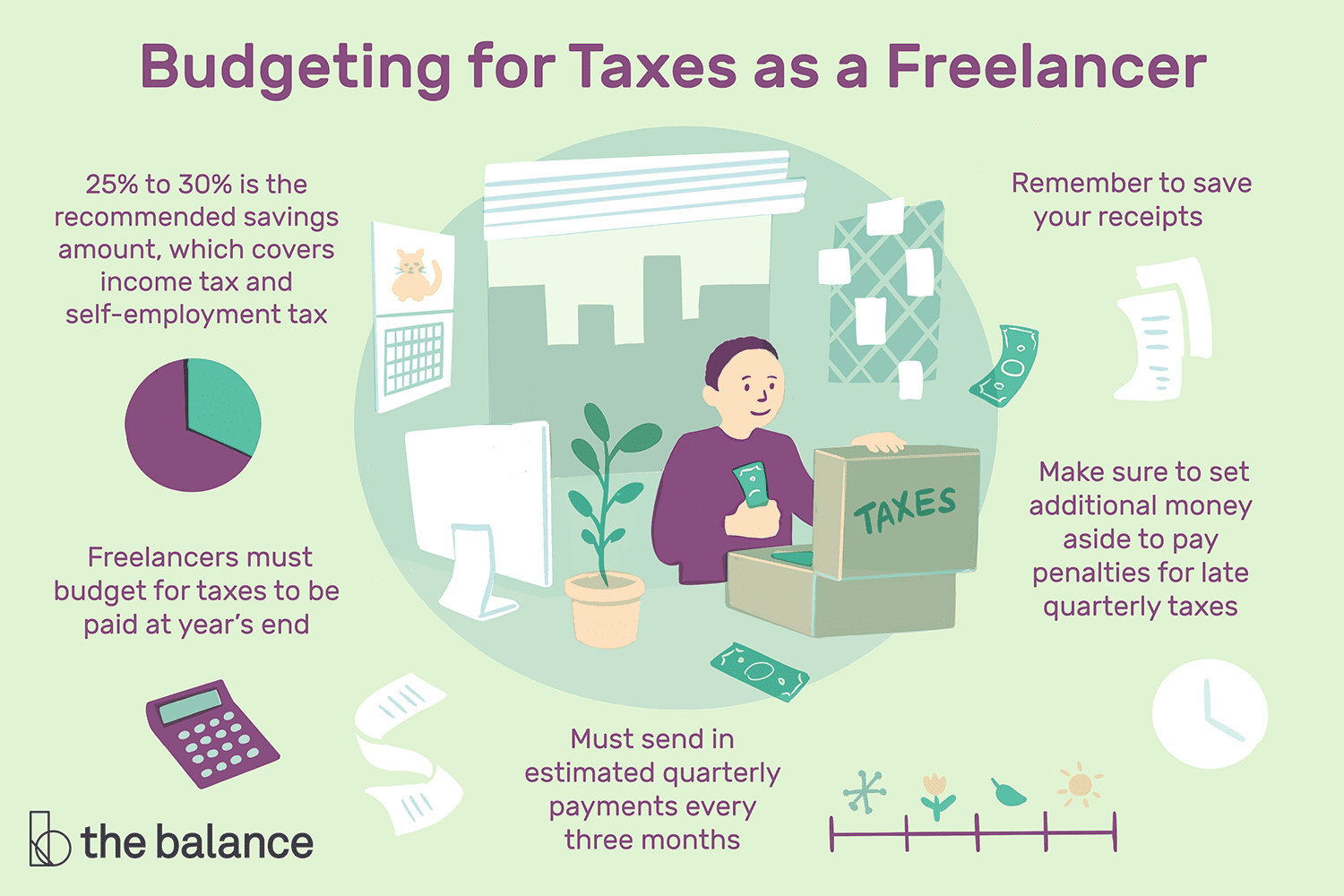

Let’s Talk About Taxes

Re: PA out of state boat purchase & taxes. When you register the boat, you will be required to pay 6% sales tax on the bill of sale price---unless it is obviously lowballed, like 100 bucks for a 1990 20 foot hull. However, if you have a reasonable price stated, the Motor vehicle license store will accept it. If the hull is newer than (I think.

Do You Pay Vat On Imports? The 15 Detailed Answer

When you purchase a vehicle through a private sale, the buyer is usually required to pay state and local taxes. In most states, buyers are required to bring a Bill of Sale , or proof of the purchase price, and a signed title document to the Department of Motor Vehicles (DMV) or motor vehicle registry agency to pay the taxes, change over the.

If I Sell My Car Do I Pay Taxes? ️ All You Need to Know About Taxes When Selling A Vehicle

If you do not pay sales tax to a registered dealer in Massachusetts, a 6.25% sales tax is due by the 20th day of the month following the: Purchase; Use; Storage or; Other consumption. For example, if you buy a boat in Massachusetts on June 1, sales tax would be due by July 20. Private sales made outside of Massachusetts

TAX ON FTMO [DO YOU PAY TAX ON FTMO? WHAT UK TAX DO YOU PAY ON FTMO ONCE PASSING THE FTMO

Transport Canada does not collect tax from the purchaser at time of registration. If RST is applicable, purchasers can make payment at any Service Ontario Center or directly to the Ministry of Finance. Boats purchased outside Canada may be subject to the 8% Ontario portion of the HST. Service Ontario centers cannot accept payment of the 8%.

Do You Pay Tax On Isa Withdrawal Tax Walls

Another very good option to avoid initial sales tax is to identify an escape clause in your local tax jurisdiction. In Maryland, for example, one need not pay sales tax on a boat that files a certification stating that it is going to leave the state within 30 days of purchase. Similarly, in Florida, a non-resident need not pay tax if the boat.

Printable Boat Bill Of Sale

Alabama has specific tax laws regarding the purchase of a boat. Depending on the boat you buy or what your boat comes with, you will pay a 2% or 4% sales tax. For instance, a boat trailer sold alone is taxable at 2%. If you buy a sailboat alone, it can be taxed up to 4%.

.